Market Update: December 22, 2025

US equities posted modest gains this week, with the S&P 500 edging up 0.1% as strength in consumer discretionary stocks offset declines in energy. The benchmark ended Friday up 16% year-to-date but slightly lower for December. Markets digested a series of delayed government reports following the shutdown, offering a complex view of the economy’s resilience.

November payroll data showed a 64,000 job increase, surpassing forecasts, even as the unemployment rate rose to 4.6%, its highest since 2021. Inflation data offered some relief as consumer prices and core inflation continued to ease, reaching their slowest pace since early 2021.

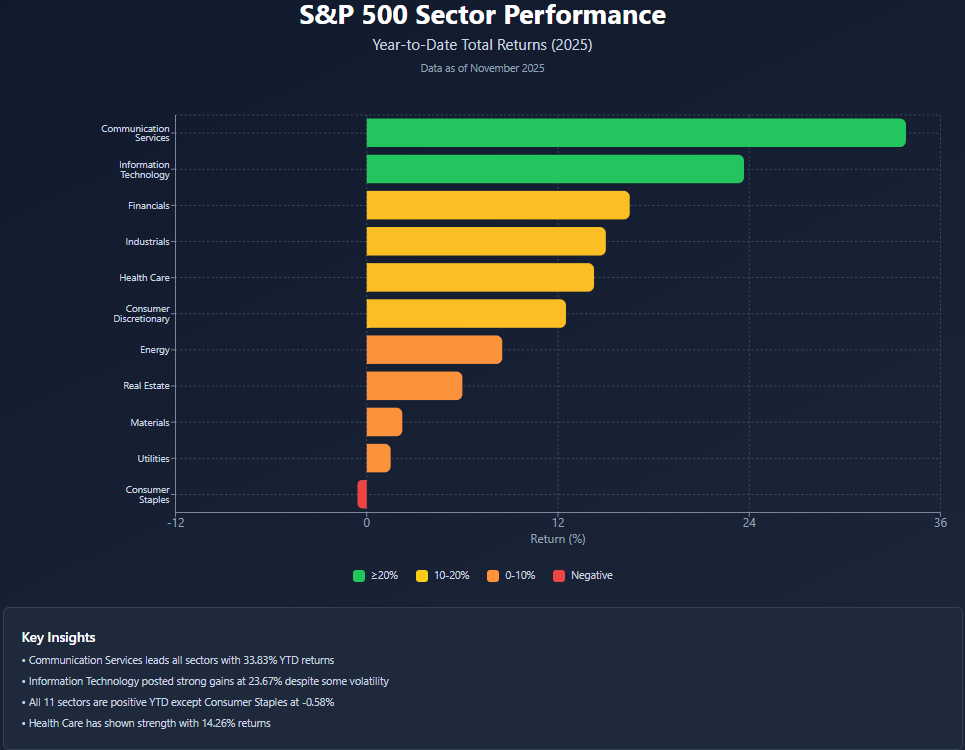

Sector performance was uneven. The consumer discretionary sector climbed 1%, led by Carnival (CCL), which jumped 13% after reporting strong Q4 results and reinstating its dividend. Materials rose 0.6%, boosted by Albemarle (ALB), up nearly 10% as analysts upgraded the stock sharply. Health care gained 0.6%, with Incyte (INCY) rising 7.6% after positive regulatory news in Europe. On the downside, energy fell 2.9% as oil prices declined; Marathon Petroleum (MPC) dropped 9.4% following executive changes.

Globally, investor sentiment cooled amid renewed concerns about an AI-driven bubble, dragging indices like the STOXX 600 and FTSE 100 marginally lower. In macro terms, the Fed’s rate cut to 3.50–3.75% highlighted growing caution around the labor market, while US Treasury yields diverged, reflecting uncertainty about growth and inflation outlooks.

Next week’s shortened trading schedule will bring delayed Q3 GDP and consumer confidence data, providing fresh insight into whether the soft-landing narrative can hold through year-end.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product.