Market Update: November 17, 2025

A Week Defined by Cautious Optimism & Crosscurrents

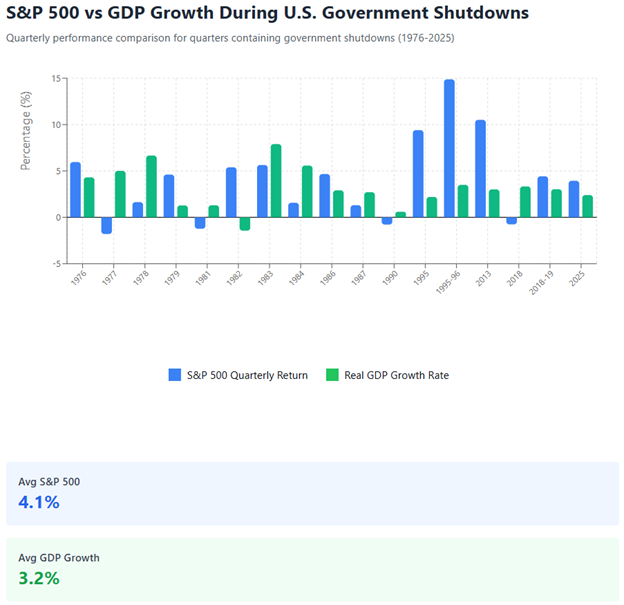

The headline story: the U.S. government has officially reopened after a record 43-day shutdown. While that’s welcome news, key economic data including September and October jobs numbers is only now starting to catch up. Investors will be watching closely ahead of the Fed’s December meeting.

Sector performance told a clear story. Health care led with a 3.9% gain, boosted by Eli Lilly’s 11% jump after announcing a genetic therapy partnership with MeiraGTx. Energy followed, up 2.5%, with Devon Energy rising 6.4% as analysts pointed to improved capital efficiency and long-term stability.

The S&P 500 inched up 0.1% this week, supported by strength in health care and energy, even as consumer discretionary and utilities lagged. The index is still down 1.6% in November but remains up 14% year-to-date, a reminder of how far markets have come despite ongoing noise.

On the downside, consumer discretionary fell 2.7%, with Williams-Sonoma sliding 7.5% ahead of its earnings release. Utilities, real estate, and industrials also posted declines.

Outside U.S. equities, global markets were pressured by concerns over stretched tech valuations and softer labor signals. Treasury yields were mixed as markets weighed weakening employment trends against evolving tariff risks. Oil prices softened on rising inventories, while gold dipped slightly despite safe-haven interest.

With earnings season wrapping up and delayed data set to resume, the next few weeks will likely shape expectations for rates, inflation, and economic momentum heading into year-end.

Bottom line: Markets are steady, but uncertainty hasn’t cleared. All eyes now shift to inbound economic data — and what it tells us about 2026 and beyond.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product.