Market Update: October 7, 2025

Markets gained last week as quiet but uneasy optimism spread across global assets. With the U.S. government shutdown limiting key data releases, investors turned their attention to inflation hedges, particularly gold and crypto. Both have rallied, but for different reasons. One is physical, the other digital, yet both reflect investor psychology as much as economics.

Weekly Market Brief

Equities advanced globally, led by international markets over the U.S. Bonds also gained as expectations of Fed easing and the shutdown’s deflationary tone pushed yields lower. Commodities were mixed, with metals, especially gold, rising on safe-haven demand, while energy declined due to higher supply and weaker demand. Crude oil fell more than 7% to about $61 per barrel after reports of an OPEC+ production increase for November.

Theme of the Week

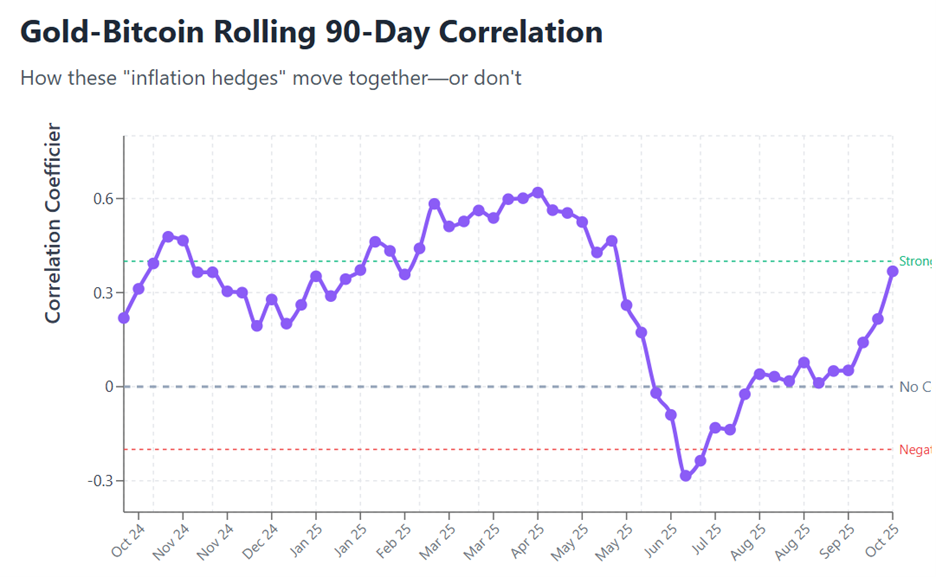

Gold and crypto share an unusual connection. Each is viewed as an inflation hedge and store of value, yet their behavior is driven as much by psychology as by fundamentals. Gold rises on fear, crypto rises on faith in disruption. Both attract investors seeking independence from policy risk, but their volatility reminds us that “safe havens” are rarely stable.

Notes from the Optimizer

Investors can hedge inflation without relying on gold bars or blockchain keys. Diversified exposure to real assets, commodities, and inflation-linked bonds can achieve similar protection without the emotional and liquidity challenges that often come with gold and crypto.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product.