Market Update: February 3, 2026

The Federal Reserve kept short-term interest rates unchanged this week, signaling patience amid mixed U.S. economic data. Durable goods orders and housing prices edged higher, while consumer confidence slipped and producer prices rose faster than expected—reminding investors that inflation still lingers.

Globally, equity markets were mixed. U.S. stocks diverged by size and sector: energy, communications, and utilities led, while health care, consumer discretionary, and materials lagged. Mega-cap tech performance was split—Meta’s strong earnings boosted sentiment, but Microsoft fell on slower cloud growth and mounting questions about AI’s impact on margins. Small caps underperformed on renewed fiscal uncertainty surrounding the Jan. 31 government funding deadline.

Abroad, foreign equities outpaced the U.S., helped by a weaker dollar and resilient data. Europe’s GDP grew 1.5% in 2025, with solid PMI readings supporting optimism, while Japan and emerging markets posted mixed results. Meanwhile, geopolitical tensions rose after President Trump briefly imposed and then rescinded tariffs tied to Greenland negotiations and announced a U.S. naval deployment to Iran.

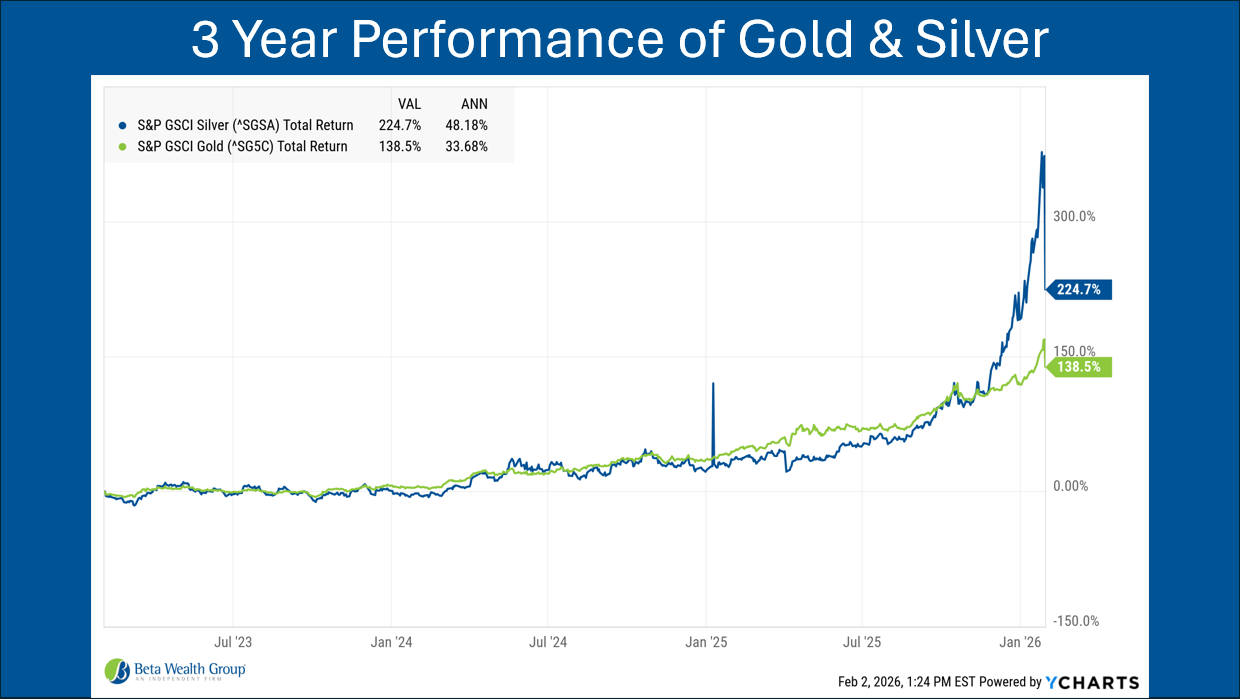

Fixed income markets were steady, though long-term Treasury yields inched up to 4.23% as global bonds sold off. Commodities were volatile—oil rallied to $65 per barrel and gold and silver surged before taking a historic plunge Friday. The U.S. dollar logged its weakest week since June, falling nearly 2%.

With earnings season halfway through, S&P 500 profit growth stands near 12% year-over-year, driven by technology and industrials. Investors now watch how Fed leadership changes and geopolitical risk shape inflation, interest rates, and confidence in the weeks ahead.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product.