Market Update: February 9, 2026

Economic data last week painted a mixed picture. ISM manufacturing moved back into expansion, services held steady, and consumer sentiment improved slightly, even as weaker job openings and claims data suggested labor market cooling. The delayed January employment report, paused by a brief government shutdown, will soon offer additional clarity.

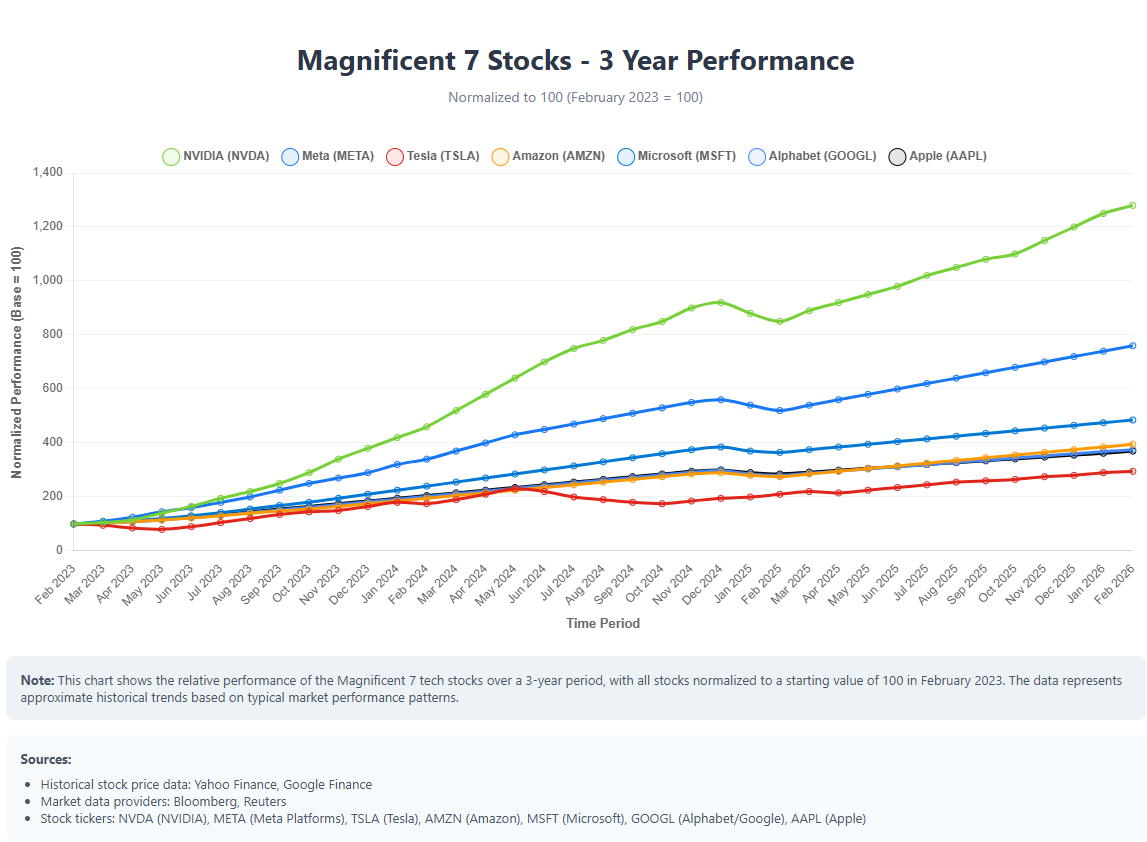

Markets reflected this uncertainty. U.S. equities ended the week mixed—value stocks gained over 2% while growth names fell by a similar margin. Consumer staples, industrials, and energy outperformed, while software saw its sharpest drop in nearly four years amid renewed concerns that generative AI tools could disrupt core SaaS business models. These fears eased by Friday, sparking a late rebound. Health care was also volatile, with weight-loss drug makers facing competitive and political headwinds.

Roughly 60% of S&P 500 companies have now reported earnings, with growth running at 13% year-over-year—well above long-term averages—but still concentrated in a few key sectors like tech and industrials. Companies with greater foreign exposure continue to outperform.

Internationally, developed markets advanced, led by Japan, while emerging markets were uneven. Central banks in Europe and the U.K. left policy unchanged, signaling patience amid balanced inflation and growth risks. Meanwhile, bonds rallied alongside equity volatility, and precious metals gained nearly 5% as other commodities declined.

As investors digest another week of policy, AI, and earnings headlines, the overarching theme remains the same: markets continue to recalibrate between optimism over innovation and caution over its near-term consequences.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product.